Freedom Holding’s Dip Is A Buying Opportunity

Oleksii Liskonih/iStock via Getty Images

I’m Still Bullish On FRHC Despite The Stock’s Dip

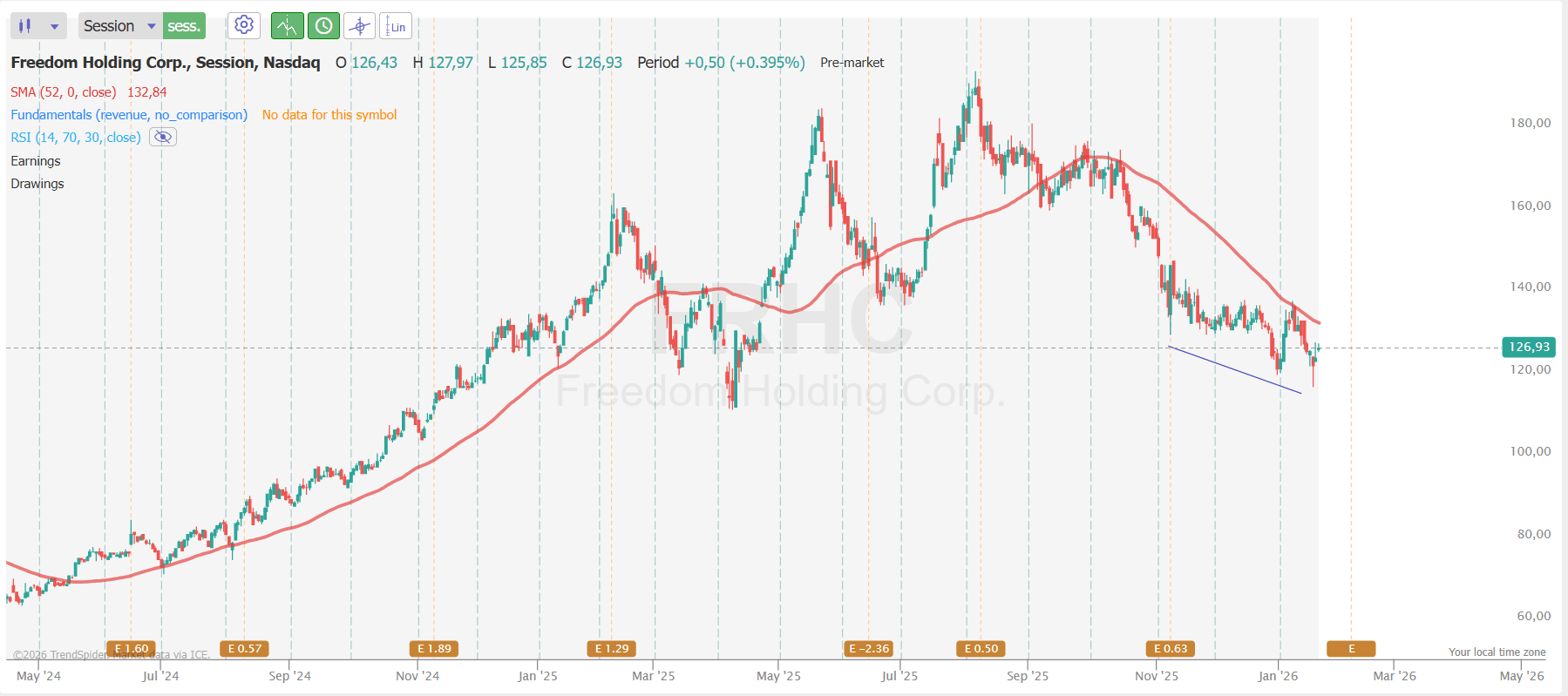

If you’ve read my column for some time, you probably recall that I’ve been a permabull on Freedom Holding Corp. (FRHC) stock since 2021, when the stock traded at about $50 apiece. The firm’s market cap went up by over 160% since then, even when we take into account the recent off-high pullback of ~31%. I view this correction as a logical consolidation that should have taken place to let all the doubters come out and let a healthier price action build.

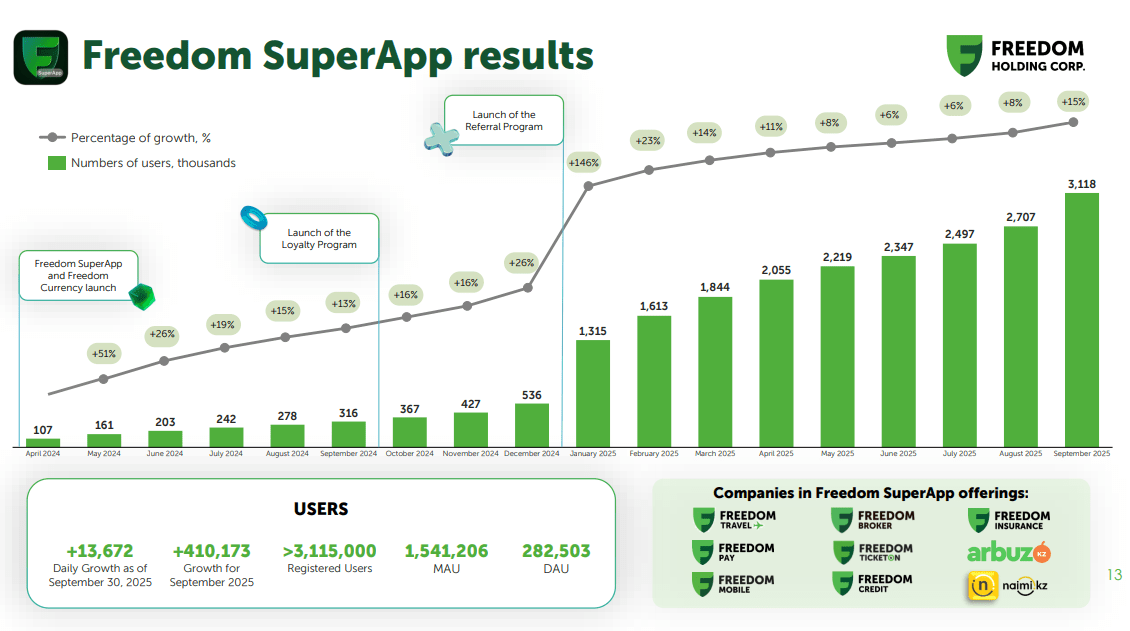

Fundamentally, FRHC’s business seems to be gaining strength, and recent management initiatives in non-brokerage businesses promise lucrative earnings potential ahead with better revenue mix diversification. I like their past super-app initiatives, which I was discussing in my previous updates in 2024 and 2025. Now we’re seeing that the super-app focus is leading Freedom to some tangible value addition and synergies, pushing the firm’s consolidated customer acquisition costs (CAC) to the downside while lifting the lifetime value (LTV) at the very same time. The ongoing improvement in FRHC’s key unit economics metrics looks solid, and I expect we’ll see higher margins in 2026-2027 when Freedom reaches a larger scale in areas that required significant CAPEX in the recent past.

For the level of both organic and inorganic growth that investors are getting by purchasing FRHC close to its local highs (near the local support levels, when we assess technicals), the stock doesn’t look expensive to me. That’s why I think FRHC deserves to be called a great «buy-the-dip» opportunity.

FRHC’s Recent Development And My Updated Reasoning For Staying Bullish

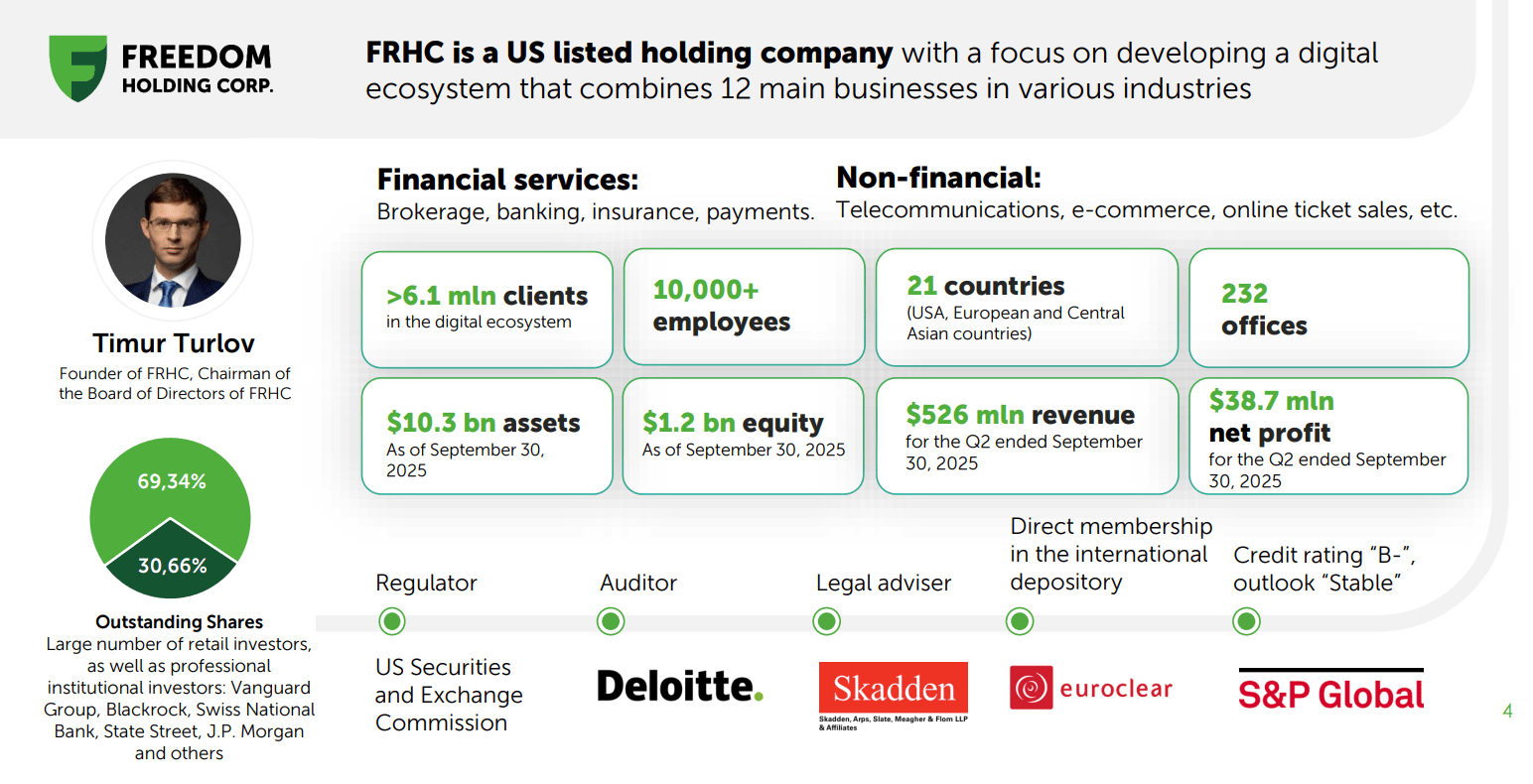

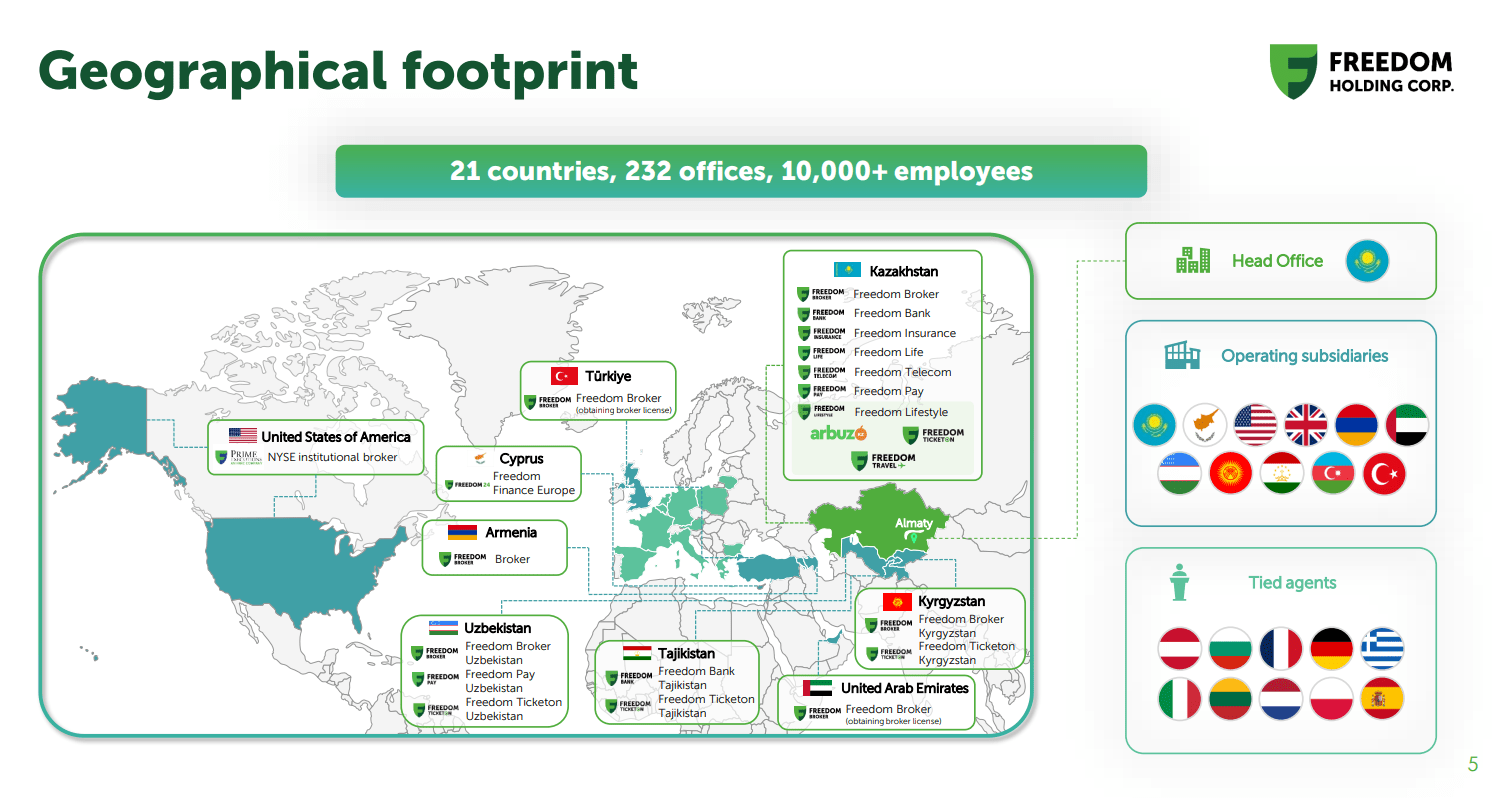

Historically, the company started out as a brokerage services provider in Kazakhstan and other CIS countries. It reached a meaningful market share in this niche in the region, with the management eventually deciding to switch the focus to banking and insurance, and simultaneously venturing into non-financial sectors (e-commerce, online ticket sales, and then telecom). The best possible way to organize all these areas of focus is to build a super app, which is exactly what Freedom did, and that’s the tech advantage over its regional peers that I’ve been noting for months.

FRHC’s IR materials

As a result of integrating its offerings, FRHC’s apps have managed to reach more than 6.1 million active clients in 21 countries (mainly Kazakhstan/Central Asia, but there are also businesses in Europe and the US). The asset base amounted to ~$10.3 billion (+17% YoY), as of September 30, 2025:

FRHC’s IR materials

FRHC’s IR materials

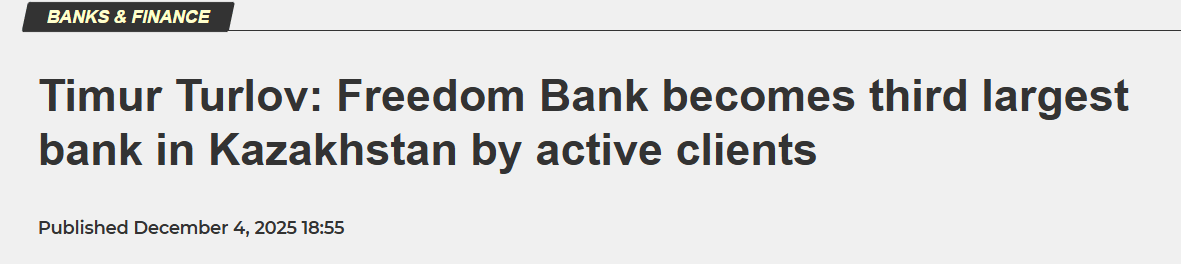

The most critical point of development for Freedom was its continued non-brokerage transition. The banking segment has become the funding and credit backbone for the entire organization these days. It serves more than 3.6 million clients, which might sound like a modest figure, but it’s actually a massive rise from last year’s milestone of 904,000 clients. This almost 4x increase hasn’t come for free — Freedom spent a lot on expansion and marketing costs, so the segment registered a net loss in the recent quarter (plus the revaluation of government bonds played as a one-off negative factor). But I think it was well worth it because now FRHC is the 3rd largest bank in Kazakhstan by its active client base, and its capabilities for supporting the entire ecosystem’s stack have improved dramatically. This view is shared by major credit agencies — in June 2025, S&P Global Ratings affirmed the «B+/B» ratings for Freedom’s core subsidiaries and revised their outlook to «Positive» (parent Freedom Holding Corp. remains «B-/Stable»), explicitly citing the firm’s strengthened risk management despite these temporary expansion-driven costs.

Kursiv

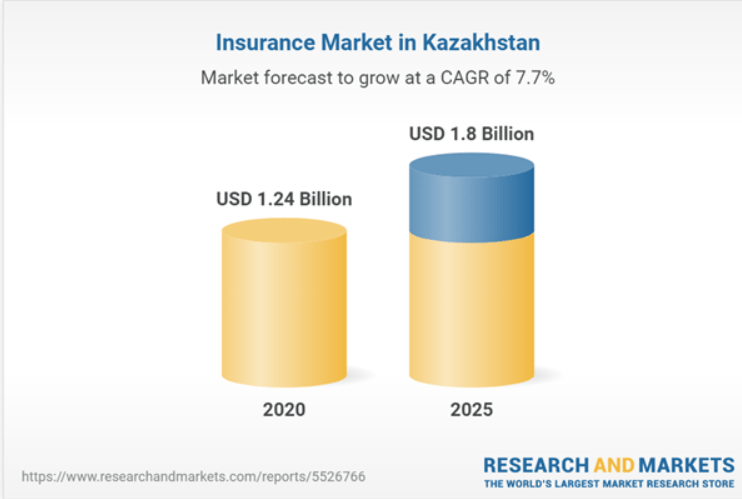

The insurance business is also doing quite well, showing a 134% YoY increase in underwriting income for fiscal year 2025. Yes, for fiscal Q2 2026 specifically, Freedom’s insurance revenues went down by 15% YoY because of the regulatory cap on agent commissions. But the demand strength for pension annuities (plus accident insurance offerings) still creates a massive opportunity for further growth, in my view, and this perspective is supported by some third-party research agencies.

Research And Markets

So, I expect higher margins from FRHC’s insurance business over time as more clients in the ecosystem begin to try the company’s offerings and programs throughout the year. The base for comparison when it comes to profitability still looks incredibly low to me, still. Other non-brokerage bets, such as telecom, payment services, and all other «lifestyle» niches, also went up in terms of sales in fiscal Q2 2026, by 9% YoY. The net loss from these ventures amounted to $64.4 million because of heavy infrastructure investments that Freedom had to make to scale faster than its peers.

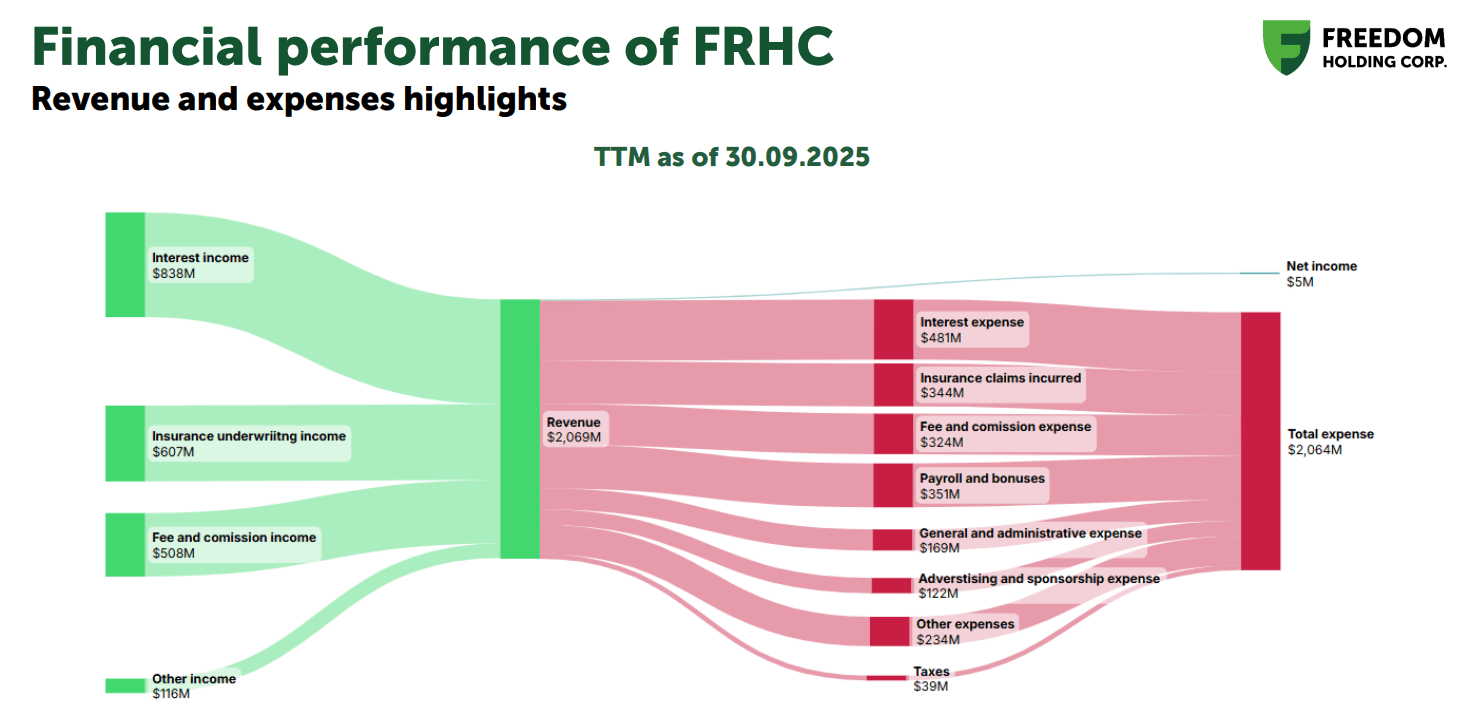

FRHC’s revenue/expense streams, Q2 2026

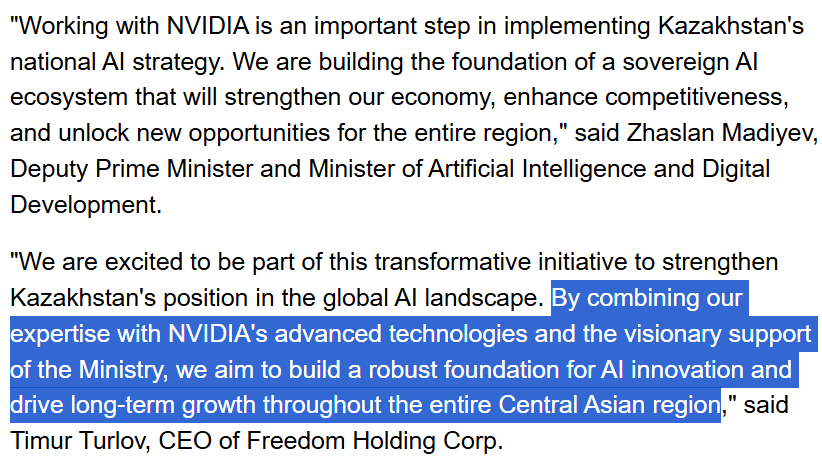

What some investors who take a bird’s eye view of Freedom’s business structure might miss is the fact that, unlike many fintech firms that rely solely on software, FRHC is building physical infrastructure through Freedom Telecom. They are willing to own the distribution channels where possible and where they can earn more over the years. As of fiscal Q2 2026, Freedom had laid more than 6,000 km of optical communication lines, and the number of data centers the firm is operating right now reached seven. Their Freedom Cloud is now the 2nd largest data center operator in Kazakhstan, and one of the biggest in Central Asia. The company is serious about AI — in November 2025, the holding’s CEO Timur Turlov, signed a $2 billion sovereign AI Hub agreement with Nvidia (NVDA) and the Kazakh AI Ministry, with plans to power a 100 MW data center with Nvidia’s chips in order to host and train large-scale AI models domestically in Kazakhstan.

Seeking Alpha, Oakoff’s notes added

In addition to that, FRHC is building data transmission channels between Europe and China through Kazakhstan, which is right between these two economic areas. We can’t quantify the financial impact from FRHC’s AI-related moves just yet, but I think they’re definitely newcomers in their region, and this pioneering status can potentially bring in some new contracts or offerings for Freedom Cloud (thus diversifying the firm’s business structure to higher-margin segments even further).

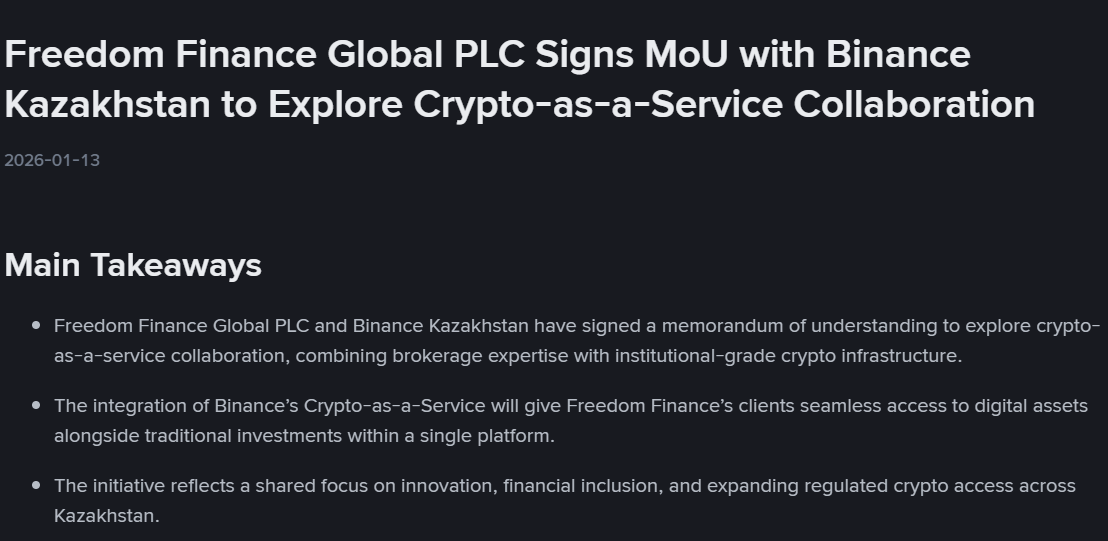

Being a fintech with such a massive scale and with a banking license allows them to cooperate on «Crypto-as-a-Service» solutions with names like Binance.

Binance’s press release

FRHC’s brokerage customers will have seamless access to trade and manage crypto assets within the unified Freedom ecosystem, being fully compliant with Kazakhstani regulations. I think this opens up another layer of incremental growth because cryptocurrencies are being massively adopted in Kazakhstan, and many people just need a safe intermediary they know well. Freedom looks like the best option as of today.

Another area where a positive financial surprise can come from is Freedom’s strategic presence in the United Arab Emirates (UAE), where Freedom established FTI (Freedom Telecom International FZE) in May 2025.

In May 2025, we established our Dubai-based subsidiary Freedom Telecom International FZE («FTI»), a strategic platform that connects telecommunications and technology companies with our existing fintech ecosystem and allows them to unlock synergies through new collaborations. FTI is focused on further expanding Freedom Holding Corp.’s ecosystem, including international expansion by way of strategic partnerships, joint ventures, and the acquisition of telecom assets.

Source: FRHC’s 10-Q

They haven’t obtained a brokerage license in the UAE just yet, but they’re in the process of doing so, and when they do, the holding will likely see more client base growth.

Better Valuation Entry Point

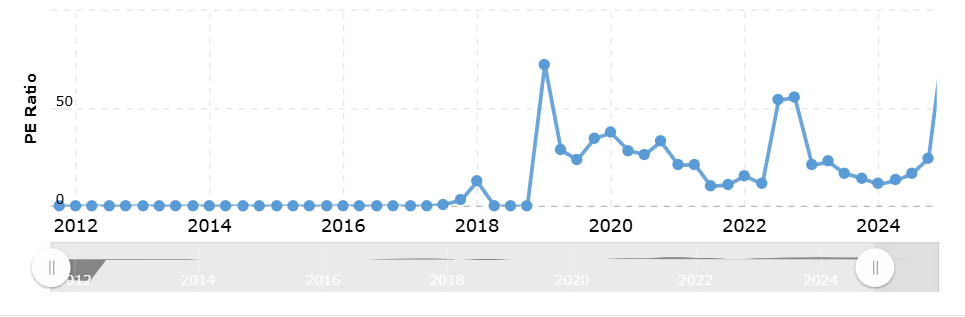

If you Google FRHC’s price-to-earnings ratio, you’ll see something from 1,500x to 2,000x, which is logical when we recall the holding’s revenue-to-earnings flow chart above. But without the net loss drag from the past, we can see that the fair P/E ratio for FRHC lies between 12-35x, based on Macrotrends data:

Macrotrends data

In 2022, 2023, and 2024, FRHC’s diluted EPS figures were $3.83, $3.45, and $6.33, respectively, based on Seeking Alpha’s normalized data (fiscal years agnostic). But if we cancel out FRHC’s high strategic spending, which depressed its EPS in fiscal 2025/26, I believe the firm could have reached at least the adjusted EPS of fiscal 2024, given the larger customer base and new synergies. FRHC stock isn’t widely covered by Wall Street analysts, still, so we can only guess here. If FRHC reaches its FY2024 adjusted EPS level next year, the stock could be valued at ~20x, and it’s pretty cheap given the top-line expansion and the AI-driven opportunities that I discussed in my article.

I think that a multiple expansion toward 25-30x would be logical, so the holding might add 25-50% in terms of its market cap in the next 1-2 years, if my core assumptions are correct.

Risks

Every investor should keep in mind that Freedom is mainly doing business in Kazakhstan, so I believe it’s destined to keep at least some level of country risk discount in its valuation in the foreseeable future. I can be wrong in my 25-30x forward P/E assumption. And more importantly, I don’t have a strict timeline in mind when it comes to FRHC’s EPS turnaround to at least its FY2024 level. This is what my valuation finding is based on, and it may never happen.

Also, the CEO of FRHC, Mr. Turlov, owns ~69.34% of outstanding shares, so the key person risks are very high. If he decides to exit or start selling actively on the open market, the lack of demand may push the stock price lower. Or if he decides to sell gradually, it might create a cap for FRHC’s appreciation potential. A lot of large institutional investors like Vanguard and BlackRock own FRHC now, but it may not be enough for supporting a sufficient level of liquidity.

Your Takeaway

Despite the elevated level of risks when dealing with emerging market stocks, in this particular case, I like the risk-to-reward setup. Yes, Freedom competes with Kaspi (KSPI) in banking and e-commerce, but its business strategy looks different, as well as its future growth areas. I like the company’s move to sovereign AI and telecom infrastructure built out — the investments they make now are essential for the holding’s leading position in the region.

The technicals generally support my bullish views on FRHC stock. While it’s trading below the 200-day moving average line, which is usually a bad sign, the RSI indicator is trying to reverse amid the price action’s decline. This is a contrarian «Buy» call. Plus, FRHC is currently close to its historically strong support zone, so the odds for an eventual reversal are rising.

TrendSpider Software, FRHC daily, notes added

I decided to keep my «Buy» on FRHC unchanged.

Source: https://seekingalpha.com/article/4862422-freedom-holding-dip-is-a-buying-opportunity